Everyone demands assistance from time to time, exactly what if that help is more than just a few hundred or so dollars, plus particularly a $1500 mortgage?

You prefer $1500 although not yes how to start? Luckily for us there exists available options, even although you need to have the money easily. Once you get the borrowed funds you need, you could potentially make a plan eg carrying out an economy fund to prepare your self for upcoming problems. Keep reading for various options to have the mortgage need.

Suppose you’ve not removed financing just before otherwise you need an excellent refresher. If so, there are lots of official certification (plus a dynamic checking account) one to loan providers have a tendency to inquire about:

1. Your revenue

For most people, its income was off 1 day job. Although not, solution sources of earnings for example SSI, offer performs, and region-date really works are only a few examples to incorporate whenever rewarding a living requirements. Lenders will have to ensure that you have enough income so you’re able to help make your mortgage costs.

dos. Capacity to Make Per Payment per month

Plus earnings, lenders usually ask for major monthly expenditures just like your book/mortgage repayment and other costs. This will provide them with a much better thought of how much your are able.

step 3 http://www.cashadvancecompass.com/installment-loans-tn/nashville. Your Creditworthiness

Finally, your credit score and credit rating should determine the type of mortgage possibilities and loan providers on the market. Certain lenders can be open to financing so you’re able to borrowers with poor borrowing from the bank records, although some may not.

Below are specific loan choice you can consider dependent on exactly what your credit rating ends up. Find out more about fico scores as well as their rankings to search for the class your belong.

Mortgage Options When you yourself have a fair Credit rating

The wonderful thing about that have reasonable borrowing from the bank is that you will have more financing options to pick from, and therefore not all the applicants gets. As well, a good credit score setting you can get better mortgage conditions (more on one to less than).

Personal loans

Personal loans are among the most made use of mortgage possibilities. With fair in order to excellent borrowing, there’s some consumer loan options to envision. A financial, borrowing connection, or an exclusive lender are all financial institutions offering personal finance.

Signature loans can be used for all kinds of expensespared so you’re able to much harder finance, the mortgage application procedure will likely be relatively small. Shortly after accepted, the funds might be delivered straight to your money.

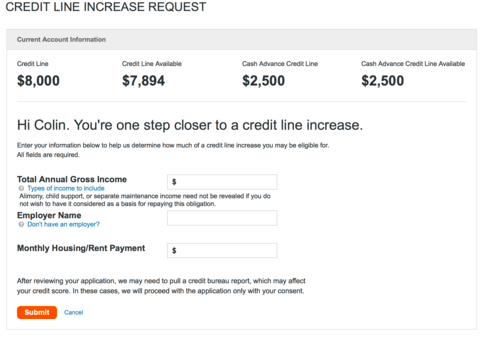

Handmade cards

Handmade cards are an alternative choice to help you borrow cash, if you have good credit. If not have credit cards to be used, check out charge card also provides having introductory zero otherwise low interest rates prices.

Cash advances

Some people decide to withdraw money through its bank card. That is called a credit card pay day loan. The attention costs are occasionally more than normal mastercard purchases. Also, there is absolutely no sophistication several months towards the notice, definition it will begin to accrue immediately.

$1500 Fund if you have Bad a credit history

Even if you reduce than simply primary credit rating, there are financing choice searching for the. Listed below are a handful of him or her:

Poor credit Unsecured loans

Some loan providers run personal bank loan options for less than perfect credit consumers. A consumer loan to possess bad credit history will be a secured otherwise personal loan solution (secured loans include guarantee, when you are unsecured do not).

Payday loan

An instant payday loan try a primary-label loan that is intended to be paid down by the next pay day, and therefore title. These money appears like an excellent way to discover the money you would like, specifically if you you need her or him quickly. However, payday loan is going to be costly, also to pay the borrowed funds you might be expected to spend a number of interest.